Our team here at Whaling City Solar aren’t just sitting at our desks all day, we’re out in the field talking with homeowners like you! We’ve heard every sort of question about solar asked in every sort of way. We’re going to take some of those questions and answer them right here for everyone to read themselves. Some may overlap, some may be out in left field, but they are all real questions we’ve been asked as verbatim as we can remember them.

Today’s question: “I’ve got literally 5 minutes before my son walks off the practice field, can you actually explain how these pay for themselves? Last solar guy 2 years ago was in my house for 30 minutes and wouldn’t cut to the chase.”

Anyone who knows me knows that filtering down nuanced information isn’t my strongest trait, but I gave it a good shot. Since I didn’t record my answer I’m going to replicate the challenge here. Considering a speaking rate of 150 words/minute, that gives me 750 words to play with. Since I’m going to cheat and use a few graphs, I’ll handicap it down to using 500 words or fewer. Our soccer dad did indeed end up going solar with us by the way.

Ready. Set. Go!

Fastest way to explain a concept is to give an example with real numbers.

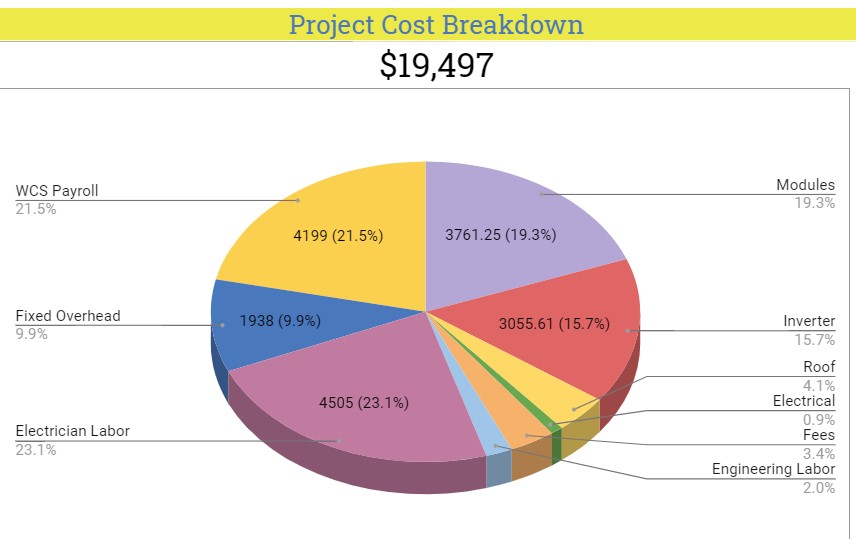

The average New England home typically costs around $20,000 to install a solar array large enough to offset 100% of their consumption. That’s the raw cost for the materials, engineering and electrician labor to install 17 solar panels which hold a 25 year warranty.

Good news is that the Federal Government is picking up part of the tab. The Federal Tax Credit reduces your tax paid the following year by 26% of the entire solar project cost. In the case of a $20,000 solar array, that one-time credit would amount to $5,200. The State of Massachusetts will also grant a flat $1,000 state tax credit, bringing the refund up to $6,200 next tax season.

Luckily for us in Eversource territory, the Massachusetts SMART solar incentive program is also still paying out high returns in 2021. This $20,000 solar array will generate ~$5,000 in direct cash payments over 10 years from the state program. Both Federal and State incentive programs are in addition to the electricity savings.

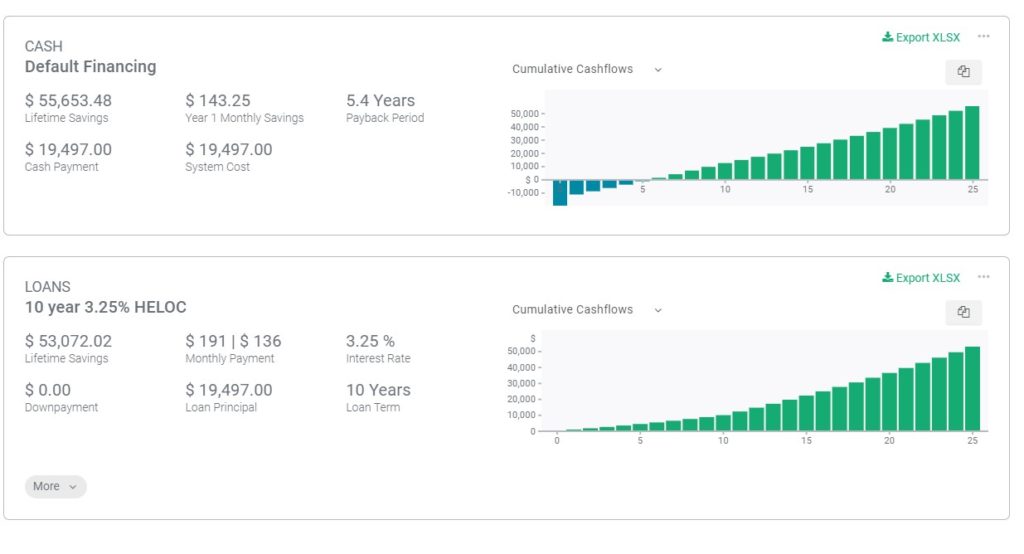

Even with these subsidies, the number of homeowners able to write a $20,000 upfront check is limited. Luckily there are many national and local financing options that allow you to transition to solar power with little, even zero, money down upfront.

If you’ve ever owned or considered buying a rental property, a financed solar array works in a similar fashion. In real estate terms, this is the ability to purchase property with no money down at closing, and then structure the mortgage such that the rent you take in exceeds your bank payment each month. A seasoned real estate investor would ask “How many can I buy today?”

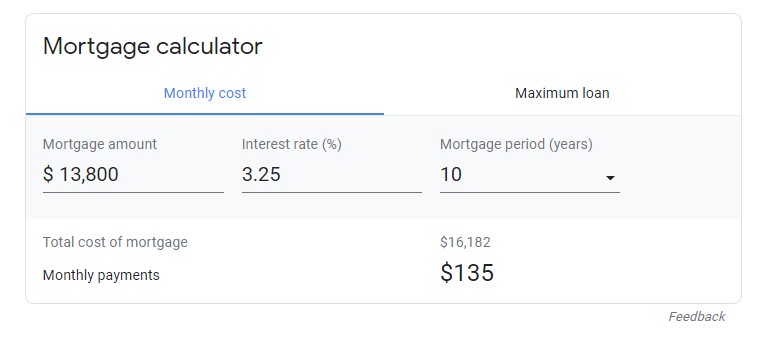

With a solar array, homeowners get the same opportunity to drive income on their own roof. With their new solar panels, the owners of our average home will see their electric bill drop from $150/month to $7/month for an annual savings of $1,700/year in electricity plus the $500 of SMART incentive payments we mentioned earlier. If they financed the full system with a 10 Year 3.25% solar loan, the annual cost would be $1,650 per year for $2,200 in total income.

The cost of financing in this manner would add about $2,400 of interest over 10 years if you only made the minimum payments. This is nothing new to us, as we understand there’s an end cost associated with zero down financing.

If you want to avoid the monthly payment and have the means to pay upfront, a $20,000 solar project will pay itself in 5-6 years and provide free power for 25 years. If you’d rather use your electric bill savings to pay for the array over time, with no upfront payments there’s nothing holding you back from making the move to renewable energy. We can have it installed in time for summer!

Finding our content interesting? We’re realizing there are more of you out there than we thought! So because someone asked, here’s a subscription form where you can get an update every time we post a new in-depth article like the one you just read.