Enough with the click-bait solar ads. You’re interested in adding solar to your home but need to know if you qualify for Massachusetts solar incentives in 2022.

Why won’t anyone just give you a list upfront? Because then you won’t make a home appointment with their sales rep.

Well we’re changing that today. Get ready for some grainy details. The truth is, the source pdf’s publicly listed on government websites are lonnnnnnng and dryyyyyyyy (how else would you describe this?). We’re going to give you these links to fact check everything we’re summarizing here, but we worked hard to condense about 200 total pages into this (much) shorter cheat sheet.

Massachusetts is one of the top ten states for solar energy with an average payback window of only 4-6 years. Let’s go ahead and jump right into all of the programs and rebates so you can make an informed decision on whether or not to go green.

Massachusetts Solar Tax Credits and Incentives

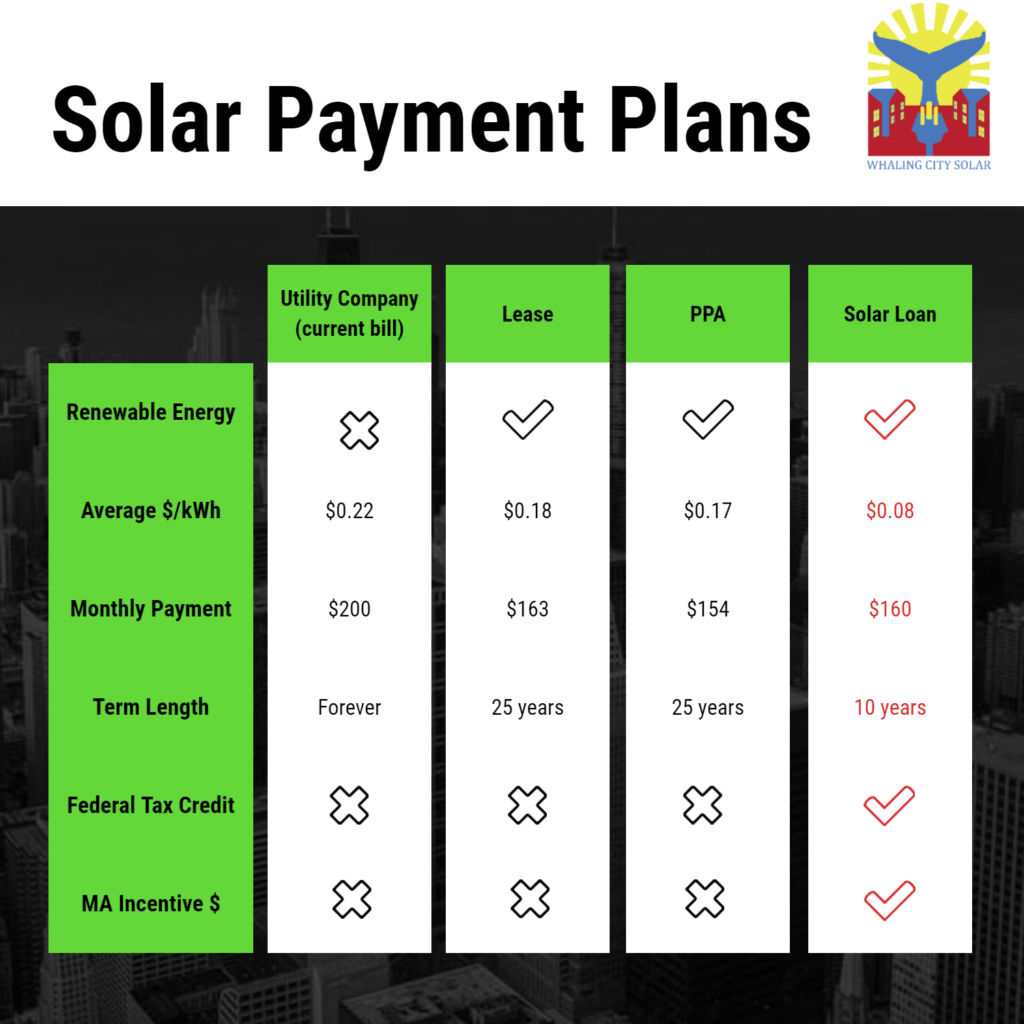

The first thing you need to know is all the solar incentives listed below are only available if you purchase the solar array. Whoever owns the installed system gets the solar incentives.

That’s important because many solar door-knockers will lead with a PPA (power purchase agreement) or lease agreement. When you lease or enter a PPA agreement with a solar company, you are forfeiting your right to both the federal tax credits and the recurring MA state incentive program.

This is the #1 reason we encourage our customers to own their own solar power systems with a financing plan if they do not have the funds to pay upfront (>50% of our customers fall into this category, you’re not alone).

In 2022, the 6 major Massachusetts Solar Incentives available are:

- The Massachusetts Solar Tax Credit

- The Federal Solar Tax Credit

- The Mass SMART Plan

- Net Metering

- Sales Tax Exemption

- Property Increase Tax Exemption

The Massachusetts Solar Tax Credit

The boring, but very real statute: https://www.mass.gov/regulations/830-CMR-6261-residential-energy-credit

Summary: New residential solar arrays in MA are eligible for a 15% tax credit applied to the fiscal year the array was installed.

This tax credit will either lower your state income tax bill or help get you a larger refund when you do your taxes. The MA Solar tax credit is also capped at a $1,000 reduction on your state taxes.

Excess credit amounts can be carried over on your personal income taxes for up to $1,000 off for three years

The Federal Solar Tax Credit

When you install solar panels you qualify for the 26% federal tax credit. The residential solar tax credit will drop to

The boring, but very real statute: https://www.irs.gov/pub/irs-pdf/i5695.pdf

Summary: When you install solar panels you qualify for the 26% Federal Residential Solar Tax Credit (sometimes referred to as the Investment Tax Credit or ITC).

This particular tax credit will drop to 22% in 2023, and it will end entirely in 2024.

26% means that the calculated credit is 0.26 times the aggregate total of the following:

- Cost of solar panels

- Labor costs for installation, including permitting fees, inspection costs, and developer fees

- Any and all additional solar equipment, like inverters, wiring, and mounting hardware

- Home batteries charged by your solar equipment

- Sales taxes on eligible expenses

If you have a quote from a solar installer already, ask your representative to confirm you are looking at the right total cost numbers.

National Grid vs. Eversource Solar Incentives in Massachusetts

Where does all this free money come from? The state already has something called a Renewable Portfolio Standard where our legislature votes whether to subsidize renewable energy or not.

When money is awarded, the released funds (known as the Solar Carve Out) are divided among Eversource, National Grid, and Unitil. This is to ensure that the funds aren’t all gobbled up by the Greater Boston hotbed and leave nothing for the rest of the state.

Meaning, the next 2 Massachusetts solar incentives will highly depend on your utility company.

If you’re in Eversource country you’re in good shape. Eversource customers are eligible for both Net Metering and the highest level of the Mass SMART Plan.

National Grid customers also receive full Net Metering, but must enter a waiting list for the Mass SMART Plan which currently is at capacity. Luckily there is an alternative REC program available to NGrid customers who don’t want to wait.

The Mass SMART Plan

The boring, but very real statute: https://www.mass.gov/doc/225-cmr-2000-final-071020-clean/download

Summary: The Solar Massachusetts Renewable Target (SMART) Plan is one of the best state-sponsored solar incentive programs for Massachusetts homeowners.

Customers who purchase an eligible solar power system before the program’s end in 2022 will get a monthly rebate. That’s cash every month.

How much every month? The Department of Energy Resources will pay a home or business owner $0.06 for each kWh generated by their solar array.

That payment will come as a direct deposit check on top of any utility bill savings. The checks are sent each month based on automatic readings from the SMART meter (wired into every new solar project), and the program lasts for 10 years from the turn on date of the array.

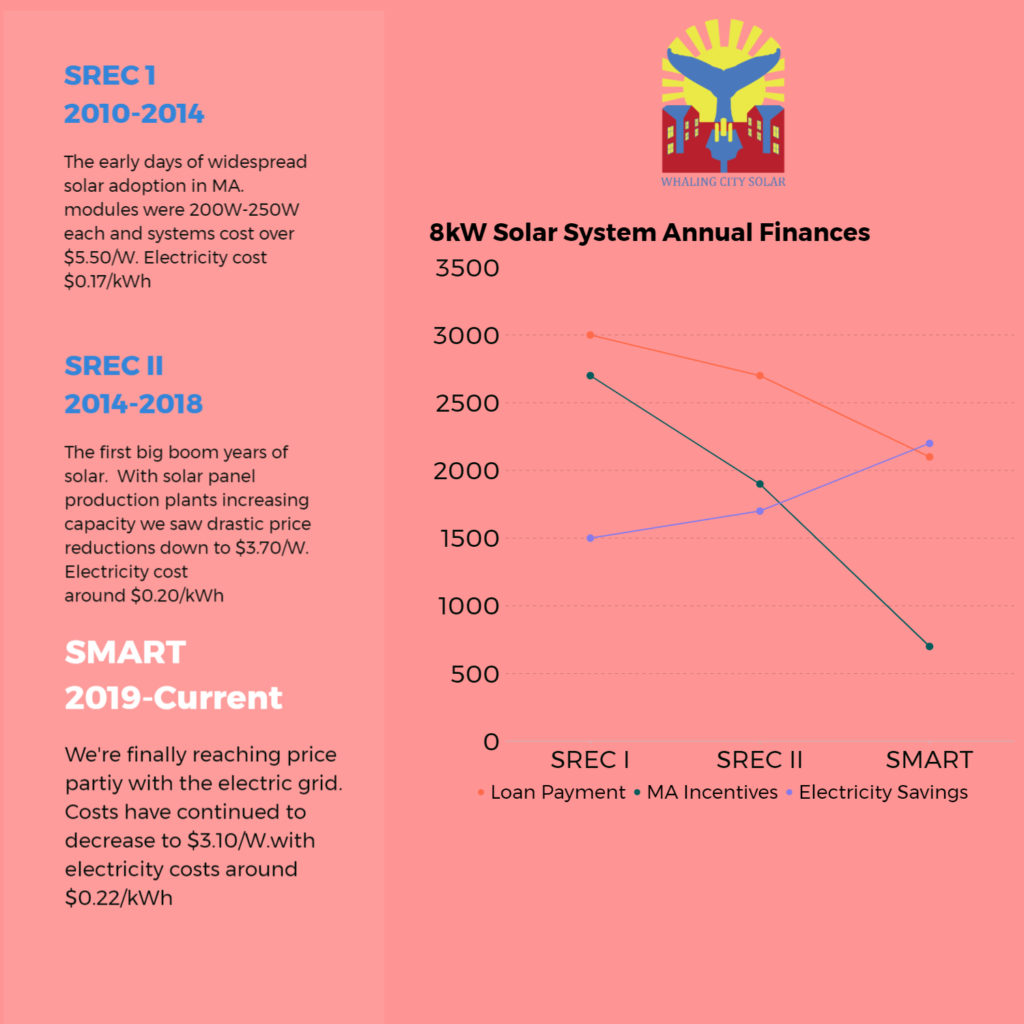

For an 8kW solar array that creates 10,000kWh’s per year, that averages to an extra $600 per year for 10 years just for owning your own solar panels!

Net Metering in Massachusetts

The boring, but very real statute: https://www.eversource.com/content/docs/default-source/rates-tariffs/ma-electric/68-tariff-ma.pdf?sfvrsn=ff21c062_8

Summary: The Net Metering program compensates you for any extra solar electricity that is not consumed on site and flows back to the grid.

When you use electricity from the grid, your meter spins forward, and you get a bill for however much energy you have used. But when you generate more energy than you use? Your meter spins backward—and you receive credits for the electricity you “exported” to the grid.

Your electric meter will keep track of how much solar power you added to the grid and subtract the power you consumed from the grid. This is your NET electrical usage.

These credits are a great way to offset the costs of your electric bill as well as other customer charges. With net metering credits, it is possible to reduce your electricity bill to zero dollars and zero kilowatt hours (kWh) used.

It can be confusing to understand how Net Metering is different from the Mass SMART plan.

If you want a more in depth look at these Massachusetts solar incentives, we just so happen to have written more about these subjects already. Check out our article here and also this one about MA SMART Program vs Net Metering.

Other Mass. Solar Incentives: Massachusetts Solar Property Tax Exemption

The boring, but very real statute: Here

Summary: Another benefit to installing solar panels is they will increase your property value.

In many areas, that would mean an increase to your property taxes, too. But in Massachusetts, solar panels cannot be counted against city or town property taxes.

Were this a home addition of the same value, you could expect to pay an additional $25,000 in taxes over the next 25 years.

Sorry, town hall! Solar panels are one improvement you can’t cash in on!

Other Mass. Solar Incentives: Massachusetts Solar Panel Sales Tax Exemption

The boring, but very real statute: https://malegislature.gov/Laws/GeneralLaws/PartI/TitleIX/Chapter64h/Section6

Summary: We’re used to sales tax on furniture, cars, food etc. but would you believe solar is exempt? The solar equipment on our back end and the installation itself skip the 6.25% state sales tax.

There’s another $1,500+ back in your pocket. This is one of the least known Massachusetts solar incentives, but it makes a big difference.

That’s all 6 Massachusetts Solar Incentives … admit it you learned a little didn’t you?

Thanks for sticking around till the end, we know this is some dense stuff.

It’s not a fake time constraint that some of these incentives are either going away soon or being phased out entirely. After finishing this article we hope you will take all the Massachusetts solar incentives into account if you’re on the fence about going solar sooner or later. They could make a big difference on your family’s electric bill.

If you’ll forgive a quick plug, all these statutes and regulations live rent free in our heads as solar professionals. If our attention to detail here gives you a hint how we’ll handle the rest of your installation project, we hope you consider having us quote your home.