According to the IRS:

“Through December 31, 2022, the energy efficient home improvement credit is a $500 lifetime credit. As amended by the IRA, the energy efficient home improvement credit is increased for years after 2022, with an annual credit of generally up to $1,200. Beginning January 1, 2023, the amount of the credit is equal to 30% of the sum of amounts paid by the taxpayer for certain qualified expenditures, including (1) qualified energy efficiency improvements installed during the year, (2) residential energy property expenditures during the year, and (3) home energy audits during the year. There are limits on the allowable annual credit and on the amount of credit for certain types of qualified expenditures (see Q -1 and 2 below). The credit is allowed for qualifying property placed in service on or after January 1, 2023, and before January 1, 2033.”

What is the Inflation Reduction Act?

Last Fall, Democrats passed The Inflation Reduction Act, which includes $369 billion in funding for climate initiatives through rebates and tax credits for consumers to help them switch from fossil fuels to electricity.

The act introduces programs that cover the costs of insulation and weatherization, to reduce a building’s energy usage. Overall, the incentives are aimed at addressing rising energy bills and tackling greenhouse gas pollution. It is important for Americans to start thinking about these incentives early, so they can take full advantage of them.

Solar is eligible!

The incentives apply to a range of products including electric vehicles, clothes dryers, induction stoves and ovens, heat pumps, insulation, and most importantly – solar panels!

We think it’s pretty awesome to get money back for turning a 100A home running on 1960’s technology into a 200A home that can power heat pumps and charge an EV with power from the sun.

Labor is included

We may include the labor costs for onsite preparation, assembly or original installation of the qualifying property. We may also include piping or wiring to interconnect the property to a home. Here in Massachusetts, this is a big deal, because the price of electricians and other boots in the field is relatively high.

Electrification improves comfort

Modern heat pumps and induction stoves accomplish more than simply switching our energy consumption from fossil fuels to gas. A correctly sized modern heat pump, with its variable speed compressor, is able to keep a home at a more comfortable and stable temperature than a gas furnace. And ditching a gas stove for induction does more than remove the source of cancer-causing benzene from our air – induction also boils water in half the time.

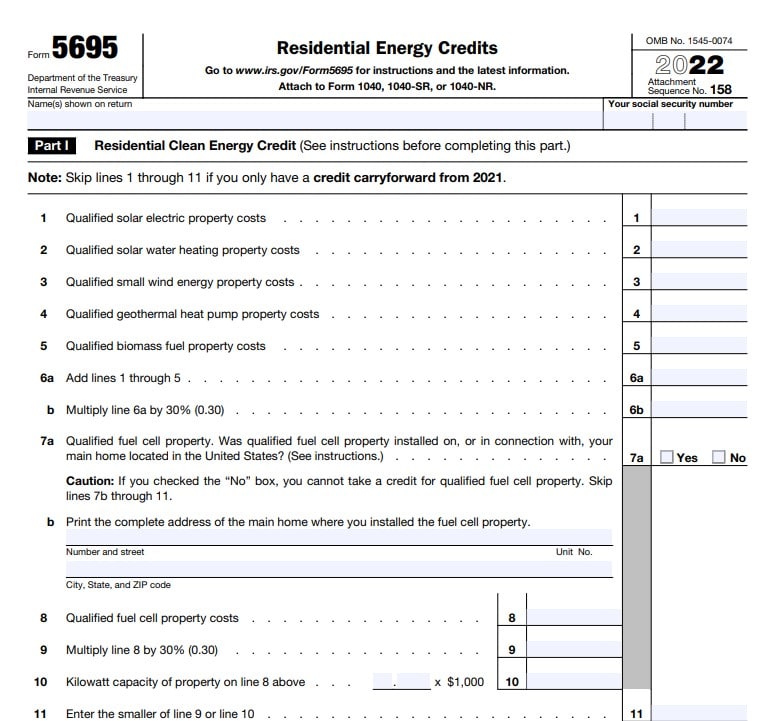

The incentives:

- Breaker box: 30% tax credit, capped at $600 (uncapped if paired with rooftop solar installation)

- Rooftop solar: 30% tax credit, average credit of $4,700 for average 6kW installation ($19,000)

- Heat pumps: 30% tax credit, capped at $2,000 annually (resets annually) for air and water heat pumps

- Weatherization and insulation: 30% tax credit for energy audits and upgrades for insulation, doors, and windows

- Residential battery system: 30% tax credit, average credit of $4,800 for average cost of $16,000

- Electric vehicles (new): Up to $7,500 off for those earning under $150,000 (single), $225,000 (head of household), or $300,000 (joint filers). Retail price must be less than $80,000 for vans and pickup trucks or $55,000 for other cars.

- Electric vehicles (used): For those earning under $150,000 (joint filers), $112,500 (head of household), or $75,000 (all other filers). Retail price must be less than $25,000.

Who is eligible?

- The credit is available for certain improvements made to the primary and secondary homes. The credit is only available for improvements made to homes used as a residence by the taxpayer.

- The credit is for qualifying expenses incurred for either an existing home or a newly constructed home.

- If a taxpayer uses the property solely for business purposes, the property will not qualify for the credit. Business use less than 20% will qualify for the full credit. Business use more than 20% must calculate the credit by allocating the expenses for nonbusiness purposes.