Hey everyone, Adam here. We hope that you’ve started on and are enjoying our sister-series An Engineer’s Guide to the Big Picture. While those articles focus on overall energy theories and the “Why?” behind going solar, this series will be dedicated to the real, practical world of solar installations. You may be asking “Why is a solar contracting company writing a Do It Yourself guide? Don’t they want me to hire Whaling City Solar to do my installation?” Well….yes…we do, but only if you value the benefits of having us the professionals take the reins. So to that end we’re going to pull back the curtain to show you the major operation steps we do week in and week out for our customers, and let you draw your own conclusions on whether you could tackle your own solar project yourself. Enjoy!

Step 3: You’ve now priced out your DIY system – how are you going to pay for it?

Out of pocket Cost: $0 (but a few hours of dedicated research time to learn the terminology)

Welcome to Step 3! In Step 1 you’ve determined that you’ve got a great house for solar, and in Step 2 you calculated a budget number for your project. The fun part about a solar system is that your project cost doesn’t just disappear like your remodeled bathroom tiles or new a Sub Zero fridge. As we’ve all heard solar pays for itself, but how? Will it take a long time? And do I need to have all the money up front?

Today we’ll learn about the tax benefits you’ll be claiming on your solar system, the state incentives available here in MA, and some financing math to consider. All calculations will be based off of the example we outlined last chapter. To remind everyone our realistic DIY system has the following characteristics:

- 12 month house consumption: 8200kWh

- Solar system size: QTY:20 of 325W Canadian Solar panels= 6.5kW capacity

- 12 month solar system production: 6.5kW x 1300kWh/kW = 8450kWh

- Homeowner direct sourced costs including inverters, racking, permitting, engineering & labor = $16,556

Basic Principles

When discussing solar payback numbers, I find it most helpful to look at the system as a cash buy first to understand the principles. Then we’ll layer the financing on top once we understand the underlying financial mechanics in play.

If you’ve been reading our site at all so far this year, one sentence continues to pop up over and over again. Solar systems are nothing more than a set of equipment that creates kWh for your home or business. So when we look at payback numbers, we first discover what the equipment costs then subtract any incentives. Then we determine what each kWh is worth to you, the property owner.

Tax Credits

In this project, your initial outlay is $16,556. That number is very real, and you’ll need to work with many the many different vendors we outlined in Step 2 before you have a working system. Luckily both the Federal government and the State of Massachusetts government are aligned right now to promote solar adoption, and are providing subsidies direct to the system owners.

Is there a political undercurrent to these subsidies? Sadly yes. Should reducing climate change and creating sustainable communities be partisan issue? Of course not! We’re not getting into any of that messy stuff in depth, but the reality is there is free government money available to help the public install solar panels, so we’re sure as heck going to factor that money into your DIY calculations.

You’re eligible for two tax credits on your solar system.

- The Federal Solar Tax Credit, sometimes called the Investment Tax Credit or ITC. The Federal Tax Credit is calculated as 26% of the total system cost, including all the components, labor and associated installer business costs. Note that this calculation doesn’t take into account the capacity of your system or how much electricity it will produce, only how much it costs you out of pocket. In our case 26% x $16,556 = $4,304. This $4,304 is not a tax write-off, rather it’s a true dollar for dollar tax credit. Meaning for 98% of DIYers that full amount will come back the following year in tax season. The other 2% may have some tax caveats you can read about here.

- The State of Massachusetts Residential Solar Tax Credit (inventive names eh?). The MA state tax credit isn’t calculated off of system cost, instead it is simply a flat $1000.

| Component | Flat Price |

|---|---|

| Raw Equipment | $10,886 |

| CAD Engineering Plans & Structural | $750 |

| SMART Application | $370 |

| Building + Electrical Permit | $250 |

| Licensed Electrician Labor + Inspection | $4,300 |

| Total | $16,556 |

| Federal Tax rebate | -$4,304 |

| State Tax Rebate | -$1,000 |

| Net Cost | $11,252 |

Electric Savings

As a start, that’s great – you’re going to recoup a big chunk of change next tax season! Now it’s time to calculate how the kWh you’re generating will do the heavy lifting to payback the remaining $11k.

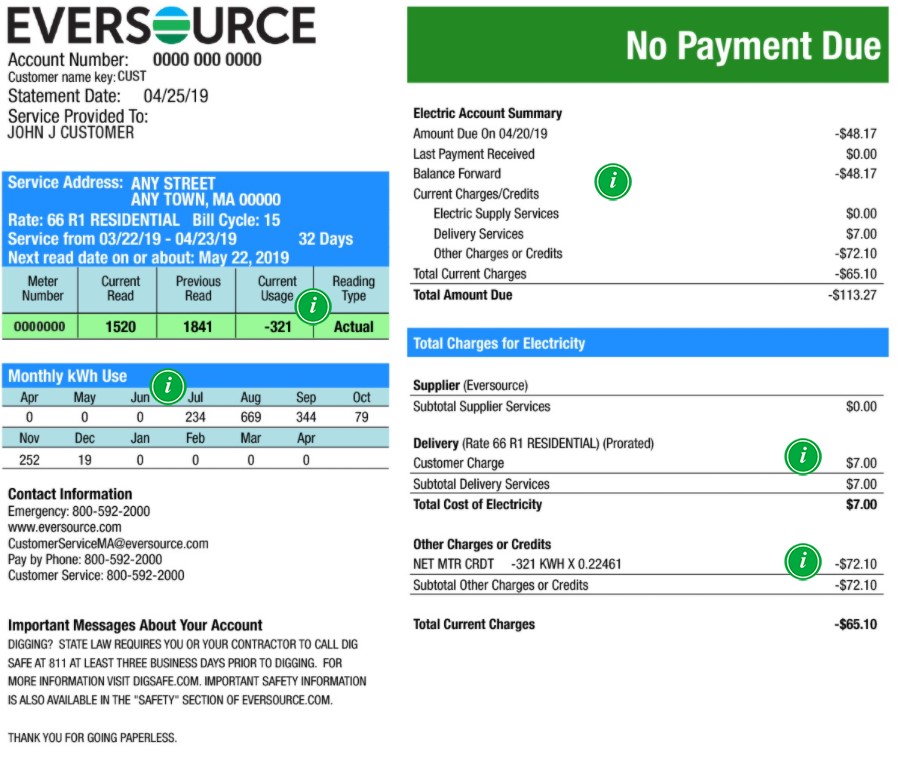

The system is going to produce ~8450kWh/year, and our house uses 8200kWh/year. We can see your system has >100% offset, but how does it really work? Does the bill just stop coming?

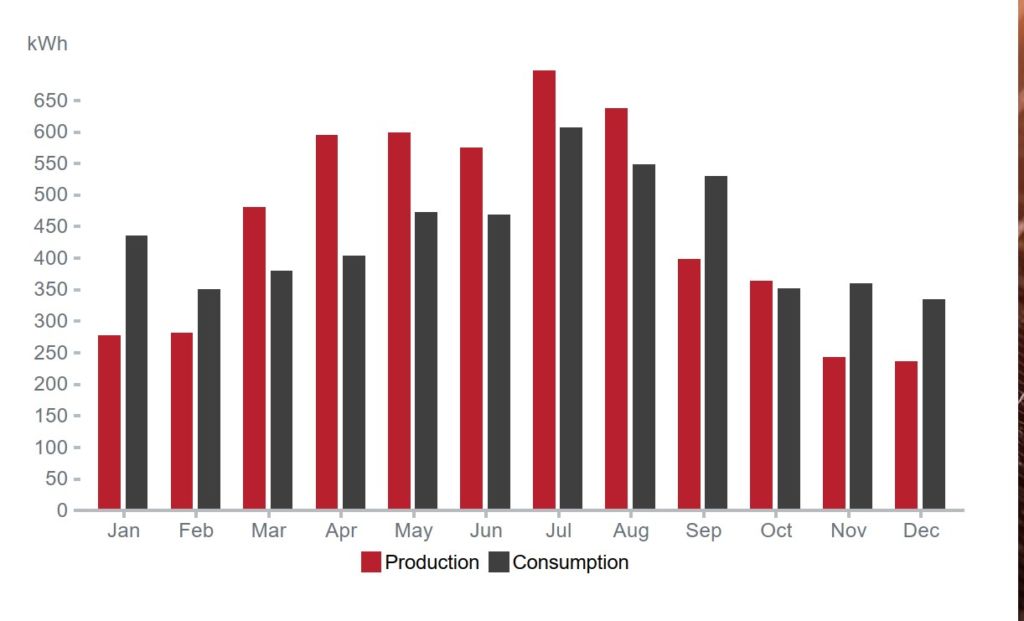

The bill doesn’t stop coming, but it does look a bit different. This is because your account will change to a Net Metering Account. Net Metering is a law in MA where you have the right to sell back all of your solar generation whether or not your home consumed all its solar power that month. This is important because both consumption and production are seasonal in nature. The solar system produces almost double with higher sun and longer days July-August as it will in Dec-Jan. Some homes use a lot more A/C in the summer and others don’t have much cooling but do happen to use electric heat in the winter. What Net Metering’s real secret allows excess production one month to carry over until the next month, when the home might use more electricity than the solar produced.

This is why I recommend you as a DIYer to look at your payments over the year, not month to month. It allows the seasonal effects to blend together and you can create a better picture of your return on investment.

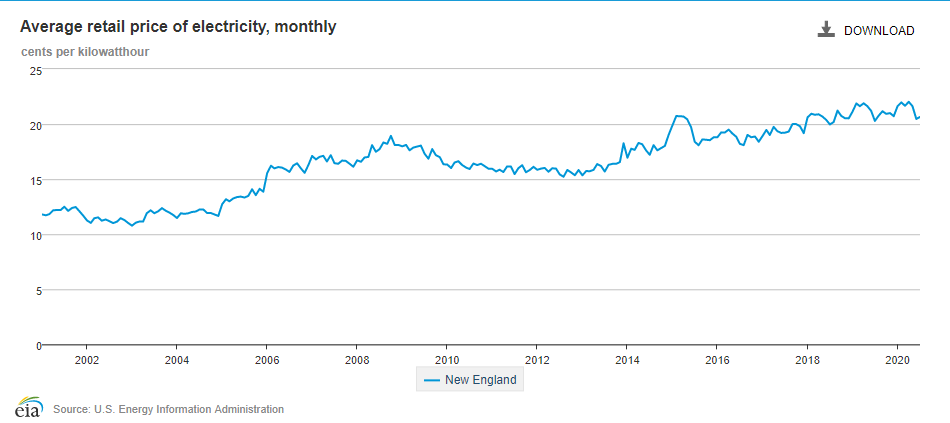

Ok, but we’re still not answering what numbers we’re putting down on our payback table. First, we know from electric bills that the 8200kWh’s the house consumed last year cost right around $1,800 to buy it all from Eversource. As a reminder that’s because the 2020 rates we’re $0.22/kWh on the electric bill. Your Net Metering credits will be given at that same rate. So 8450kWh of generation would be worth $1860/year to your bill. What’s the deal with that extra $60? Unfortunately they won’t send you a check for the difference, only carry it over to the following year. However, it’s still a good idea to size the system a bit larger to leave room for growth for usage, whether it be for an EV or other electric upgrades.

I want to quickly address another very important factor here, which is what happens when the utility changes its rates. If in five years the rate is now $0.26/kW, what happens? Your house usage of 8,200 kWh now costs $2,132 from the pole. Do you have to pay the ~$300 difference? Not at all! It’s because the Net Metering rate is required to also raise to $0.26/kWh for your solar production. The solar system is producing the same 8,450kWh per year, but now it’s worth $2,197/year not $1860/year. This has a powerful effect on the payback of your system in your favor, but requires a bit of a crystal ball with regard to future electricity prices. For our DIY payback calcs we’re going to be super conservative and pretend the price of electricity will never go up.

| Component | Flat Price | |

|---|---|---|

| Raw Equipment | $10,886 | |

| CAD Engineering Plans & Structural | $750 | |

| SMART Application | $370 | |

| Building + Electrical Permit | $250 | |

| Licensed Electrician Labor + Inspection | $4,300 | |

| Total | $16,556 | |

| Federal Tax rebate | -$4,304 | |

| State Tax Rebate | -$1,000 | |

| Net Cost | $11,252 | Payback Term in Years: |

| Electricity Savings (25 year warrantied system) | $1,860/year | 6.04 Years |

| Total Electric Savings (25 years) | $46,500 | |

| Net Savings System Lifetime | $35,248 |

Bonus Incentive: The Solar Massachusetts Renewable Target fund (SMART fund)

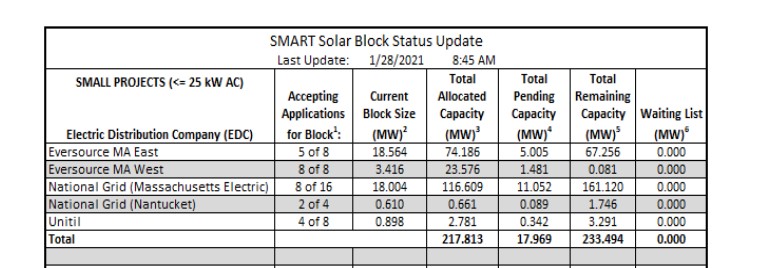

We also have another state incentive to account for, and lucky for us it’s one of the best in the country: the MA SMART program. This program was created to help MA install over 3,200,000kW of solar to become a national example of an achievable sustainable grid. If you install solar in MA and own your system, you’re eligible for a cut of this fund. First you should double check to make sure they have room left in the program for your project. See below from their website since that Eversource East is accepting applications in block 5 of 8. That means you’re still good to go. You’ll have to do some reading and spreadsheet work found in the Resources tab to calculate your end incentive rate – but I’ll save you the work here, and say that as of February 16th when this article was published the bonus incentive rate is $0.08/kWh.

We’re going to add this extra income into our ROI table next to the electricity generation since it’s being calculated per kWh. The only difference is the SMART payment will come for 10 years vs. the electricity savings that will last the the solar system’s lifetime.

| Component | Flat Price | |

|---|---|---|

| Raw Equipment | $10,886 | |

| CAD Engineering Plans & Structural | $750 | |

| SMART Application | $370 | |

| Building + Electrical Permit | $250 | |

| Licensed Electrician Labor + Inspection | $4,300 | |

| Total | $16,556 | |

| Federal Tax rebate | -$4,304 | |

| State Tax Rebate | -$1,000 | |

| Net Cost | $11,252 | |

| Electricity Savings (25 year warrantied system) | $1,860/year | Payback Term in Years: |

| MA SMART payments (10 Years) | $676/year | 4.43 Years |

| Total Electric Savings (25 years) | $46,500 | |

| Total SMART payments (10 Years) | $6,760 | |

| Net Savings System Lifetime | $41,998 |

Pretty much there now aren’t we? Your ~$11,000 net cost system creates a minimum of ~$2500 ($200+ a month) of value a year. So now we see how and why this solar system pays for itself in under 5 years, and then keeps printing money for another 20+ years after.

Self-Financing

Let’s be frank – as good as a deal this is, many of us don’t have $16,000 just sitting around waiting to be spent. Does that mean you have to start saving a solar fund to start your DIY project? Not by a long shot.

You see by 2021 pretty much every bank has realized what a safe investment a solar system is for their customers, and are happy to lend you money to purchase one. Without getting into unsecured vs. secured loans – let’s assume you don’t want to attach your property (like a Home Equity Line of Credit) to the loan and instead ask for a simple home improvement loan. I’d expect you can find a 5.99% loan fairly easily. Is that good enough? In the spirit of our DIY guide let’s use a normal internet tool to help make sense:

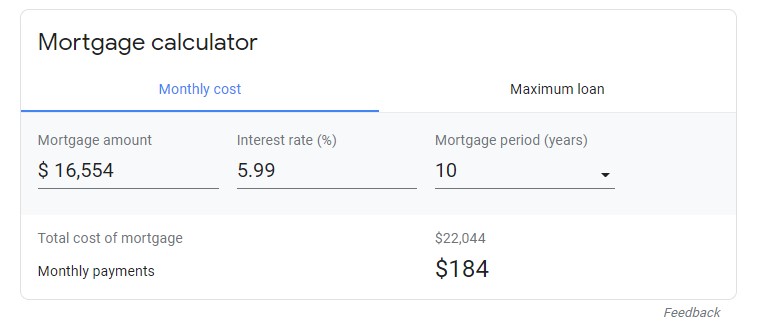

Any mortgage calculator will help you see the question through the bank’s eyes before you go. If you wanted to borrow $16,554 to build your solar system and pay it back over 10 years @5.99% APR – your monthly payment will be $184/mo. That’s pretty great, since you already learned how your new solar system is generating a minimum of $200/month! Put in other words we see that the output of the solar system will pay for your loan immediately starting on month 1, and also give a $5,000 tax benefit to put in your pocket.

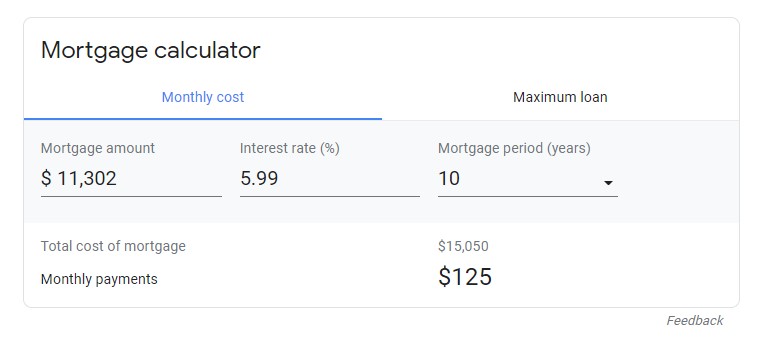

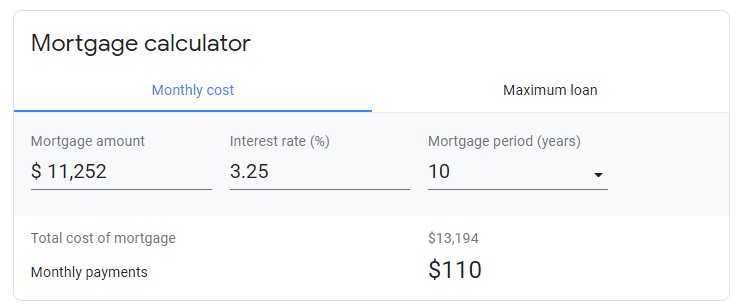

Did that extra bit about the $5,304 tax credit stick out to you? That’s yours to do with what you wish. One suggestion would be to pay it directly into the loan principle and chunk down the monthly payment. Paying that lump sum back to the bank next year and refinancing the $11,252 balance after taxes looks real nice:

Perhaps you are doing other home projects and have a Home Equity Line of Credit already open. Local banks such as First Citizens bank are offering HELOC rates at 3.25%. Borrowing the money in this manner would make boost your yearly savings even higher.

Look at you go now. This is the methodology I would recommend to those to who didn’t have the full $16k liquid this year. Let review the 5.99% example again in simple sentences.

You go this month and sign a home improvement loan with your local bank so you don’t need to dip into your checking account and buy a $16,552 solar system. The loan payments total $2,208/year while the electricity savings and SMART payments generate $2,536/year in year 1. You do your taxes next year, get a big $5,304 check from the government for helping the environment, and decide to re-amortize that payment back to the loan. You’re now paying $1500/year to have a beautiful new solar system generating $2,536/year and reducing your carbon footprint. After 10 years the loan is paid off completely and enjoy $2,536/year in savings in exchange for what you pay to have the sun shine down each day.

Conclusion

Full disclosure: this Step 3 is my favorite part of the whole 8 Step process. That moment when the money side ‘clicks’ in someone’s head and they go “Wait does everyone know about this?” I want everyone to realize that whether they do their project as DIY or hire a solar contractor, all the mechanics work the same as how we just outlined. If you have enough sunlight on your property, the finances always work in your favor. Maybe it’s financed over 20 years, maybe it’s different equipment or incentives, but the principles remain unchanged.

Somebody is going to buy equipment, someone is going to install it, the public governing bodies will approve it, and either an individual or a bank pays for it. End result is a upgraded home with a system that’s worth over 5x what it cost to install.

Now that you know your numbers, and see that you’re self qualified financially – let’s start building right? Almost there…. while you do have your financing secured it isn’t time to buy materials yet, first you’ll need to get started on engineering. Stay tuned for Masterclass: 8 Steps to a DIY Solar Installation – Step 4 – Solar Design!

Joing Over 500,000 Students Enjoying Avada Education now

Immediately upon receipt of your information one of our staff members will reach out to ask whether you prefer a Remote Site Visit (Zoom, Google Meetup, etc.) or in In-Person Site Visit with our co-founder Adam. You will be provide priced, project timeframe and projected financials within 24 hours of your site visit. Stop procrastinating, you could have an answer to how much solar panels cost for your home this week!